FinCEN’s March 2025 Rule Lifts Reporting Burden for Domestic Companies

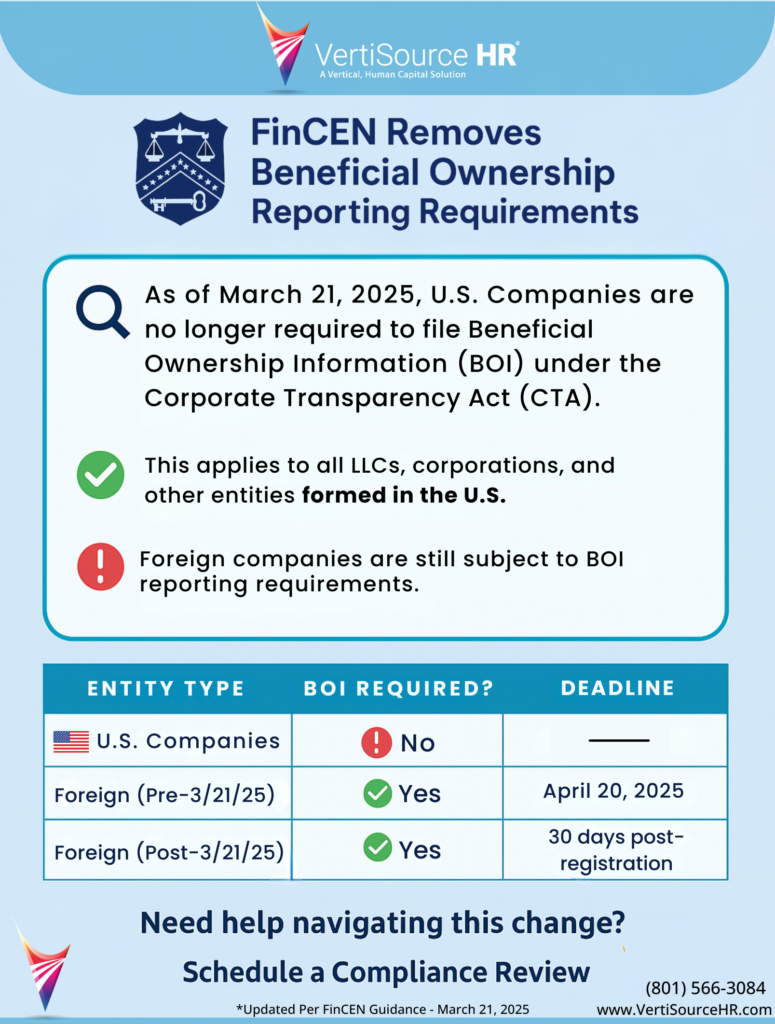

On March 21, 2025, the Financial Crimes Enforcement Network (FinCEN) announced a major change to the Corporate Transparency Act (CTA) reporting rules.

U.S. companies and U.S. persons who are beneficial owners of U.S. entities are no longer required to report Beneficial Ownership Information (BOI) to FinCEN.

This change simplifies compliance for small businesses, LLCs, and corporations that had been preparing to meet new reporting deadlines under the CTA.

What’s Changed?

BOI Reporting Removed for U.S. Companies

If you operate a company formed or registered in the U.S., you are no longer required to submit BOI under the CTA.

Foreign Reporting Companies Still Required to File

Foreign entities registered to do business in the U.S. must continue to file BOI reports. Key deadlines include:

- Registered before March 21, 2025 → File by April 20, 2025

- Registered on or after March 21, 2025 → File within 30 days of registration

What This Means for Business Owners

- U.S.-based entities: You’re exempt from filing unless you’re part of a structure that involves foreign registration or control.

- Foreign entities doing business in the U.S.: Stay compliant and meet deadlines to avoid penalties.

Let VertiSource HR Help

We’re helping clients navigate these updates in real time. Whether you’re unsure of your filing requirements or need help managing complex ownership structures, VertiSource HR has your back.