Effective January 1, 2023, California enacted a new pay transparency law (SB 1162) with the intent to

amend both the California Government Code section 12999 and the California Labor Code section 432.3.

As an enhanced hybrid of both California Codes, SB 1162 seeks to vastly expand the employer’s pay data

reporting requirements and increasing applicant and employee pay scale transparency.

For the employer who fails to comply, the Labor Commission penalties can range from $100 to $10,000

per violation (depending on the circumstance). Furthermore, it authorizes any person (job applicant or

employee) aggrieved by a violation of these provisions to bring a civil action for injunctive and any other

appropriate relief.

Senate Bill No. 1162

Going further than any other pay transparency requirement within the United States, California’s SB1162

introduces four new primary obligations for its employers to follow:

- Employers with fifteen (15) or more employees are now required to include a pay scale for all

applicant job listings; - Employers (regardless of size) are now required to provide employees with a pay scale

information upon their request; - Employers must now maintain pay history information for the duration of an employee’s

employment, to include three years after their employment has ended; and - Employers with one hundred (100) or more employees must now submit an annual “pay data

report” to the California Civil Rights Division (formally known as the California Department of

Fair Employment and Housing) by the second Wednesday of every May starting May 2023.

- Pay Scale Requirement With All Applicant Job Listings

Under the existing California Labor Code section 432.3, employers were required to provide applicants

with a pay scale for a position, they have interviewed for upon reasonable request. However, SB 1162

has amended this requirement to require employers with fifteen (15) or more employees to now include a pay scale for any position posted on a job listing. This obligation also extends to any third party that may have been contracted by the employer to announce, post, publish or otherwise make known of a job listing.

- Pay Scale Required Upon Employee Request

SB1162 also expands upon the existing California Labor Code section 432.2, by placing the requirement

for employers to provide their employees with a pay scale for the position to which they are currently

employed in upon reasonable request.

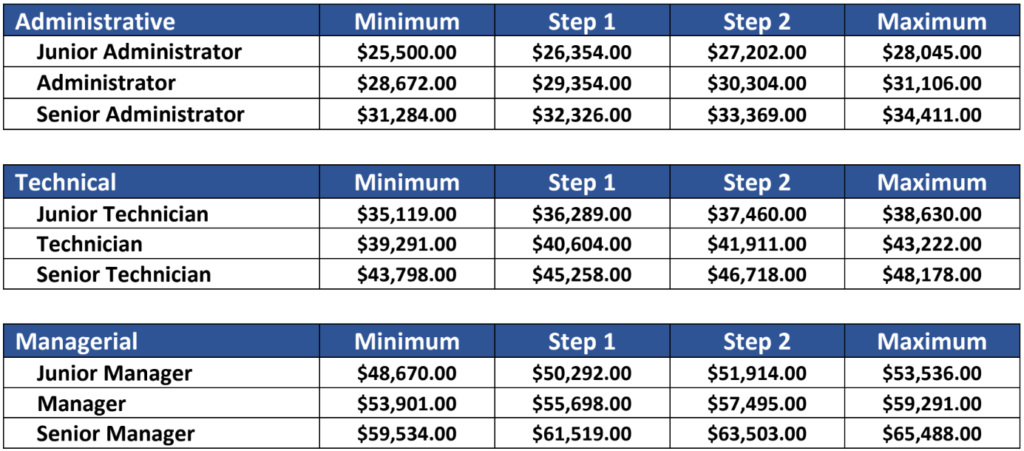

Definition and Example Of A Pay Scale

For purposes of this article, a pay scale is defined as the salary or hourly wage range that an employer

reasonably expects to pay for the job position to be filled. Pay scales do not include bonuses,

commissions, tips, or any other benefits. For wages that may include piece rate or commission, the

employer is to identify what one could ‘reasonably expect’ to be paid for working in that job position.

A sample of a pay scale is provided below; however, it should be noted that pay scales may be as basic

or as intricate as desired, depending on how the employer wishes to articulate the requirements for

each level of pay (i.e., education level, job knowledge, position experience, years of service, etc.).

Minimum: Entry level for the given job position. The employee is expected to fulfill the basic minimum

job requirements for the position.

Step 1: The employee is experienced with the knowledge and skill necessary to accomplish the majority

of job requirements with some supervision and follow-up. Employees with salaries between the

Minimum and Step 1 are still in a learning phase as they work to become more skilled in the job

requirements of the position.

Step 2: The employee is highly experienced with the knowledge and skill necessary to exceed job

requirements. Employees whose salary falls between Step 1 and Step 2 are in the maturity phase as

they seek to master their job.

Maximum: The employee consistently produced consistent, quality results that are well above the job

requirements for the position. Employees whose salary falls between Step 2 and Maximum are in the

leadership phase as they have demonstrated superior leadership skills and a strong commitment to the

organization.

- Maintaining Pay History

SB 1162 also created a new record-keeping requirement for employers. Specifically, the requirement

for employers to maintain records of the job title and wage rate history for each employee during their

employment and for three (3) years after their employment. During this period, the records must be

made readily available for inspection by the Labor Commissioner. In addition, the failure to maintain

such records can create a rebuttable presumption in favor of an employee’s claim if the employer has

failed to keep such records. - Annual Pay Data Report

Finally, SB 1162 expands the content of the annual data report requirements to employers with one

hundred (100) or more employees as it alters the timeline for data reporting and extends the reporting

for employees hired through labor contractors. For example, California Government Code section 12999

had required employers to submit their pay data reports on or before March 31st of each year. SB 1162

now alters the deadline to the second Wednesday of May each year, starting May 2023. Employers with

one hundred (100) or more employees will be required to file, regardless of their EEO-1 filing status.

It also expands the reporting of pay data to include the median and mean hourly rate for each race,

ethnicity, and sex within each job category. Employers with multiple establishments will now be

required to submit a report covering each establishment. No longer is the requirement for a

consolidated report to be used.

Finally, SB 1162 imposes an additional reporting requirement to employers with one hundred (100) or

more employees hired through labor contractors within the previous calendar year to submit a separate

pay data report identifying those workers. Employers must disclose in the pay data report the ownership

names of all labor contractors used in supplying their employees. This pay data report is also due by the

second Wednesday of May each year, beginning on May 10, 2023.

References:

https://www.littler.com/publication-press/publication/show-me-money-california-enacts-new-pay-disclosure-requirements#:~:text=The%20law%

20requires %20employers%20with,by%20race%2C%20ethnicity%20and%20gender.

https://www.shrm.org/resourcesandtools/legal-and-compliance/state-and-local-updates/pages/california-pay-transparency-guidance.aspx

https://ogletree.com/insights/californias-new-pay-transparency-law-pay-data-reporting-obligation-changes-for-2023/#:~:text=Beginning%20in

%202023%20for%20the,employers%20under%20the%20new%20law.

https://www.littler.com/publication-press/publication/california-labor-commissioner-releases-limited-guidance-pay